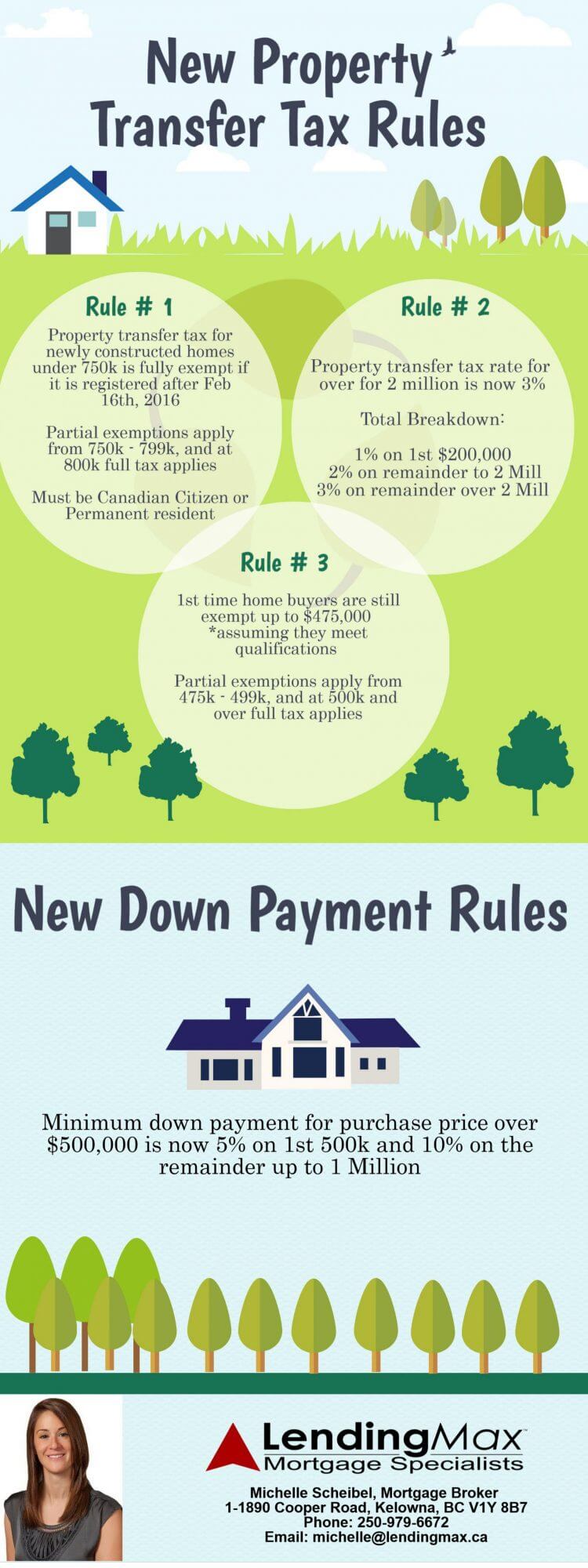

New Property Transfer Tax Rules

Rule #1: New Construction

Property transfer tax for newly constructed homes under $750k is fully exempt if it is registered after Feb 16th, 2016.

Partial exemptions apply from 750k – 799k, and at 800k full tax applies.

Must be Canadian Citizen or Permanent resident.

Rule #2: Homes over 2 Million

Property transfer tax rate for over 2 million is now 3%

Total Breakdown:

1% on first $200,000

2% on remainder up to 2 million

3% on remainder over 2 million

Rule #3: First time home buyers

1st time home buyers are still exempt up to $475,000

*assuming they meet qualifications

Partial exemptions apply from $475k – $499k

$500k and over, full tax applies

For the best rates or to talk about your options on a new or existing mortgage, contact us today!